John Zhen Fu Pang

About Me

I spend half my time as a Senior Research Scientist in the Energy Systems Group at A*STAR’s Institute of High Performance Computing, where I apply control, learning, and optimization algorithms to study smart grid operations. At IHPC, I also manage the Energy Systems group, and am the Principal Investigator (PI) for the “Modelling the Electrification of Singapore’s Harbourcrafts (MESH)” project, which is funded by the Singapore Maritime Institute and the Public Sector Science and Technology Planning and Policy Office (S&TPPO). I am also co-investigator of two TRANS Grant projects. I spend the other half of my time at the S&TPPO, under the Prime Minister’s Office, where we help guide and enable government agencies towards Modelling and Simulation (M&S) solutions for policy and planning.

Before starting work in Singapore from 2020, I worked as a Data Scientist at Schlumberger’s Software Technology and Innovation Center at Menlo Park, CA, USA. In that one-year period at SLB, I was selected to present at the company’s Reservoir Symposium and was later also awarded the Initiator Award at SLB’s FIZZ Symposium. I also did two internships at STIC in the prior summers before joining full-time.

On the teaching/academic front, I previously co-lectured an undergraduate Game Theory course as an adjunct lecturer in the Engineering Systems and Design Pillar at SUTD with Prof. Lingjie Duan in 2022. In 2024, I took over the instruction of the Game Theory course fully as Adjunct Assistant Professor at SUTD. From time to time, I also share my experience as an A*STAR research scientist to students from various levels.

I received my Ph.D. from Caltech’s Computing and Mathematical Sciences Program in 2019, where I was supervised by Prof. Adam Wierman and Prof. Steven Low. At Caltech, I received the Amori Doctoral Prize in CMS for my dissertation on Online Platforms in Networked Markets. Prior to that, I obtained my Bachelor’s Degree in Mathematical Sciences (First Class Honors) from the Nanyang Technological University’s School of Physical and Mathematical Sciences in 2013 under the Accelerated Bachelor Program. My Ph.D. and B.Sc. studies were funded by Singapore’s National Science Scholarship and the A*STAR Undergraduate Scholarship.

My research lies at the intersection of optimization, control, and operations research – with a focus on formulating and designing algorithms that are provably “not too bad” in both the offline and online optimization settings. My research is applied in the area of power and energy systems, networking, economics, and computer science.

Outside work, I enjoy spending time with my wife Odelia and daughter Eliora, playing badminton, and watching chess.

About Energy Systems Group in IHPC, A*STAR

The Energy Systems Group at IHPC (housed under the Systems Science Department) aims to enable clean, resilient, and autonomous energy systems in Singapore. We develop optimization algorithms and simulation models to study the impact of policy and plans in Singapore, exemplified by the Singapore Integrated Transport and Energy Model (SITEM) project. The SITEM project studies the impact of vehicle electrification and EV charger placement on Singapore’s grid infrastructure. This has since spun off to projects for electrification in the Maritime and Aviation sector. Moving forward, we are also working with partners from and enabling collaboration between academia, government, and industry to study the energy transition in Singapore towards our 2050 targets of a Net-Zero future.

We are looking for researchers (both B.Sc./M.Sc. and Ph.D. graduates) who are interested in applying computing (modelling/simulation/optimization) and data science (including Machine Learning/Artificial Intelligence) in the area of energy systems. Do drop me an email if you are interested. Strong B.Sc./M.Sc./Ph.D. candidates that are interested may also write to me to arrange for a summer or half-year internship. I recommend Ph.D. candidates who are looking for funding opportunities in Singapore to check out the SINGA Award and ACIS Scholarship. International Ph.D. students may also consider funding via the ARAP Scholarship.

Recent News

- [Apr. 2024] Completed MESH Update to MPA/ACE(Ops) and did our mid-term review to Singapore Maritime Institute reviewers.

- [Apr. 2024] Invited to visit the Singapore District Cooling setup at Marina Bay as part of the SGTechTeam. Interesting to learn of how SDC uses district cooling and thermal storage to participate in demand response (DR) in Singapore.

- [Apr. 2024] Invited to observe SCDF’s EV Burn Trial. A registered Hyundai Ioniq was burned with two main purposes - to find out the efficacy of fire blanket to contain the fumes, and the ability to reduce temperature via various measures.

- [Apr. 2024] Invited to witness the Pilot Launch Trial of the first public e-Harbourcraft charging at Marina South Pier.

- [Mar. 2024] Had the privilege represent S&TPPO to attend Airspace World 2024 in Geneva, Switzerland.

- [Mar. 2024] Attended IHPC’s Leadership Advance where we had discussions on how to best align IHPC’s directions with A*STAR and the larger research ecosystem.

- [Feb. 2024] Phase 2 of SITEM begins! IHPC will be undertaking an extension of the SITEM study to include the study of heavy goods vehicles, and emerging technologies such as vehicle-to-grid (V2G).

- [Jan. 2024] I will be lecturing 40.316 Game Theory at Singapore University of Technology and Design as Adjunct Assistant Professor.

- [Jan. 2024] Funding for the second phase of the Centre for Energy and Emissions Modelling (CE2M) has been approved. The Energy Systems group is the key contributor in one work package to help improve long term power sector decarbonisation planning. CE2M was previously featured on this Energy Market Authority (EMA) Media Release. The Media Release also mentions one of the TRANS Grant projects we are working with EMA to perform the next stage of translational research and development in order to deploy the developed distribution network twin in SITEM into an end-user software solution usable by EMA by 2025. This software solution will help to assess the impact of significant demand changes expected in the distribution grid as energy sector decarbonises.

- [Dec. 2023] The Energy Systems Group (together with S&TPPO) hosted the “Power and Energy Systems of the (near) Future” Workshop, held at IHPC on 11th December 2023, prior to the IEEE Conference for Decision and Control (held in Singapore).

- [Nov. 2023] I represented S&TPPO at the Smart Cities Connect Conference, held in Washington DC, from 28th to 30th November. We also visited Leidos and Johns Hopkins University during that trip.

- [Oct. 2023] The Energy Systems Group is excited to host Dr. Ben Kroposki, who kindly gave a talk on 19th October 2023.

- [Sep. 2023] I represented A*STAR at the Singapore-Rotterdam Green Corridor Workshop, held in Rotterdam, from 18th to 20th September. I also visited TU Delft during that trip.

- [Sep. 2023] I am transitioning towards a joint appointment with the Public Sector Science and Technology Planning and Policy Office (S&TPPO), under the Prime Minister’s Office (PMO). I will be working on developing a Modelling and Simulation Capability Center in the area of energy, emissions, environment and sustainability (CE3S).

- [Jul. 2023] The SITEM project contributed towards the One Public Service Award, part of the Public Service Transformation Awards, handed out during 2023’s Public Service Week. See more in this A*STAR LinkedIn Post.

- [Jun. 2023] I will be speaking on the Sustainability Panel “Can AI Shape the Path to a More Sustainable Future?” at TechXLR8 Asia on 9th June 2023!

Recent Courses

- [Sep. 2023] I will be attending the A*STAR’s Managerial Development Programme from 6th to 8th September 2023.

- [Sep. 2023] I will be attending a one-day course on Power BI on 5th September 2023.

- [Mar. 2023] Attended the 3rd Systems Engineering Foundation Course organised by S&TPPO.

Older News

- [Apr. 2023] We had our final Steering Committee meeting for the SITEM project, and will be proposing for a continuation and expansion of the project in SITEM 2.0! I have also been promoted to Scientist 2! (July 2023 Update: The title has now been updated to Senior Scientist 1 as part of a title unifying exercise across A*STAR. )

- [Mar. 2023] I will be the Principal Investigator (PI) for our new project on charging infrastructure for electrification of the maritime industry in Singapore. This project, funded by both the Singapore Maritime Institute and S&TPPO for 2 years, is code-named MESH, which stands for “Modelling the Electrification of Singapore Harbourcrafts”. See MPA’s recent post on “Strengthening Singapore’s Competitiveness as a Hub Port and International Maritime Centre”.

- [Jan. 2023] Our paper on “Distributed Online Generalized Nash Equilibrium Tracking for Prosumer Energy Trading Games” with Asst. Prof. Zhaojian Wang (SJTU) and co-authors has been accepted for presentation at, and publication in the proceedings of, the 2023 American Control Conference (ACC), to be held in San Diego, California, USA from May 31-June 2, 2023. Big congratulations to Yongkai as well on being a finalist for the Best Student Paper Award. You can find a version of this publication on arXiv.

- [Dec. 2022] I will be taking over as Capability Group Manager for the Energy Systems group at A*STAR’s Institute of High Performance Computing. I have added a description of the Energy Systems group above.

- [Nov. 2022] Our review paper titled “Online Optimization in Power Systems with High Penetration of Renewable Generation: Advances and Prospects” with Asst. Prof. Zhaojian Wang (SJTU) and other co-authors have been accepted into IEEE/CAA Journal of Automatica Sinica, (IF:7.847, Citescore: 13.0 - 1/118 in Control and Optimization).

- [Oct. 2022] Our team at IHPC will be visiting a number of research labs and startups in the U.S., including NREL, Colorado State University, LBNL, UC Berkeley, Stanford, PowerFlex, Caltech, and MOEV Inc.

- [Sep. 2022] I received a teaching score of 4.8/5.0 for 40.316. Big thanks to my students for their attention through evening classes in their final year.

- [May. 2022] I will be co-lecturing 40.316 Game Theory at Singapore University of Technology and Design.

- [Apr. 2022] Our Singapore Integrated Transport & Energy Model (SITEM) project won the Ministry for Trade and Industry Firefly Borderless Silver Award.

- [Mar. 2022] I am helping to organize and will emcee the launch event for A*STAR’s Software and System Engineering Communities of Practice (CoP).

- [Feb. 2022] I am giving a talk on “Platforms in Networked Cournot Competition: Access or Allocation Control” at SUTD ESD Research Seminar Series.

- [Jan. 2022] Our paper titled “Transparency and Control in Platforms for Networked Markets” got accepted into Operations Research.

- [Jan. 2022] I will be moderating a session by Prof. Cédric Villani at the Global Young Scientist Summit 2022.

- [Dec. 2021] I am helping to organize and will emcee the Maritime AI Workshop, co-organized by IHPC and Singapore Maritime Institute (SMI).

Teaching/Mentoring

- Capstone Co-supervisor for Jonathan Chia, Yale-NUS College, AY22-23 (Supervised with Asst Prof Michael Choi)

- Lecturer, 40.316 Game Theory at Singapore University of Technology and Design, 2022

Selected Publications [ Google Scholar]

-

OR

Operations Research (OR), Volume 70, Issue 3, 2022.

OR

Operations Research (OR), Volume 70, Issue 3, 2022. -

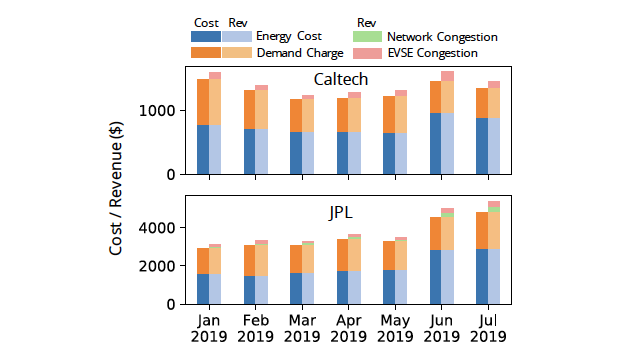

EPSR

Elsevier Electric Power Systems Research (EPSR), 2020.

EPSR

Elsevier Electric Power Systems Research (EPSR), 2020. -

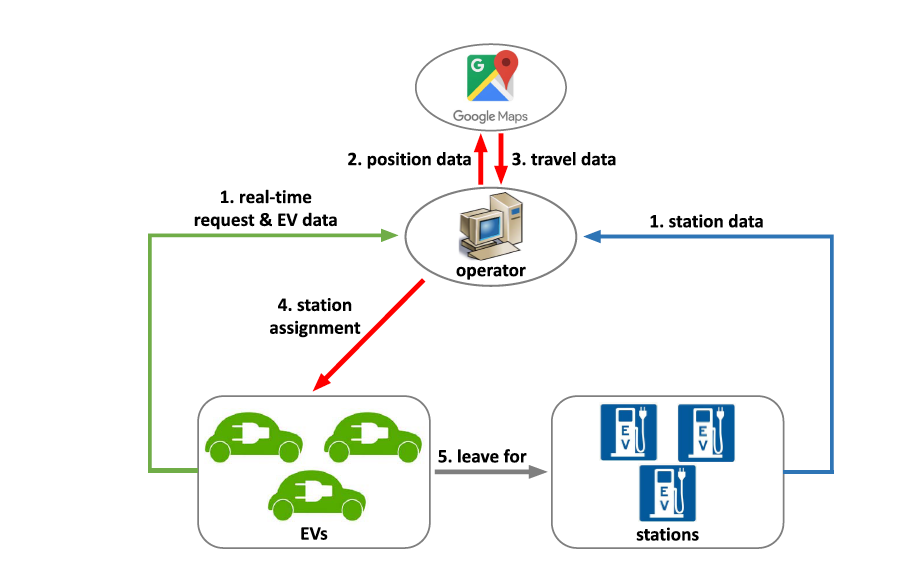

IEEE T-ITS

IEEE Transactions for Intelligent Transportation Systems (T-ITS), 2020.

IEEE T-ITS

IEEE Transactions for Intelligent Transportation Systems (T-ITS), 2020. -

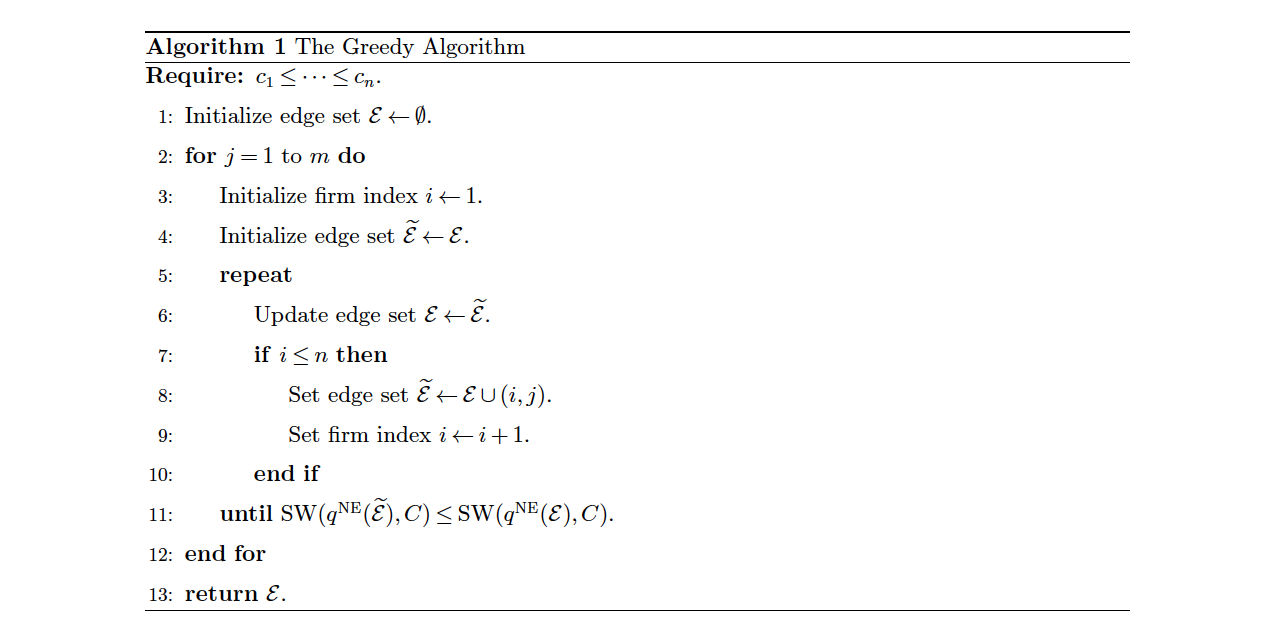

SIGMETRICS

Proceedings of the ACM on Measurement and Analysis of Computing Systems (Sigmetrics), 2019.

SIGMETRICS

Proceedings of the ACM on Measurement and Analysis of Computing Systems (Sigmetrics), 2019. -

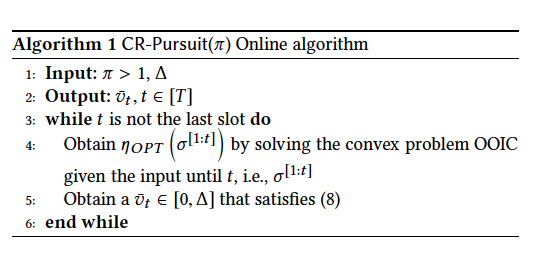

IEEE TPS

IEEE Transactions of Power Systems (IEEE TPS), 2019.

IEEE TPS

IEEE Transactions of Power Systems (IEEE TPS), 2019.